- Swiss Islamic Finance

- Posts

- Ethereum ETFs Surge & Bitcoin Dominance Signals the Next Rotation

Ethereum ETFs Surge & Bitcoin Dominance Signals the Next Rotation

ETH ETFs Catching Up to Bitcoin

Macro View

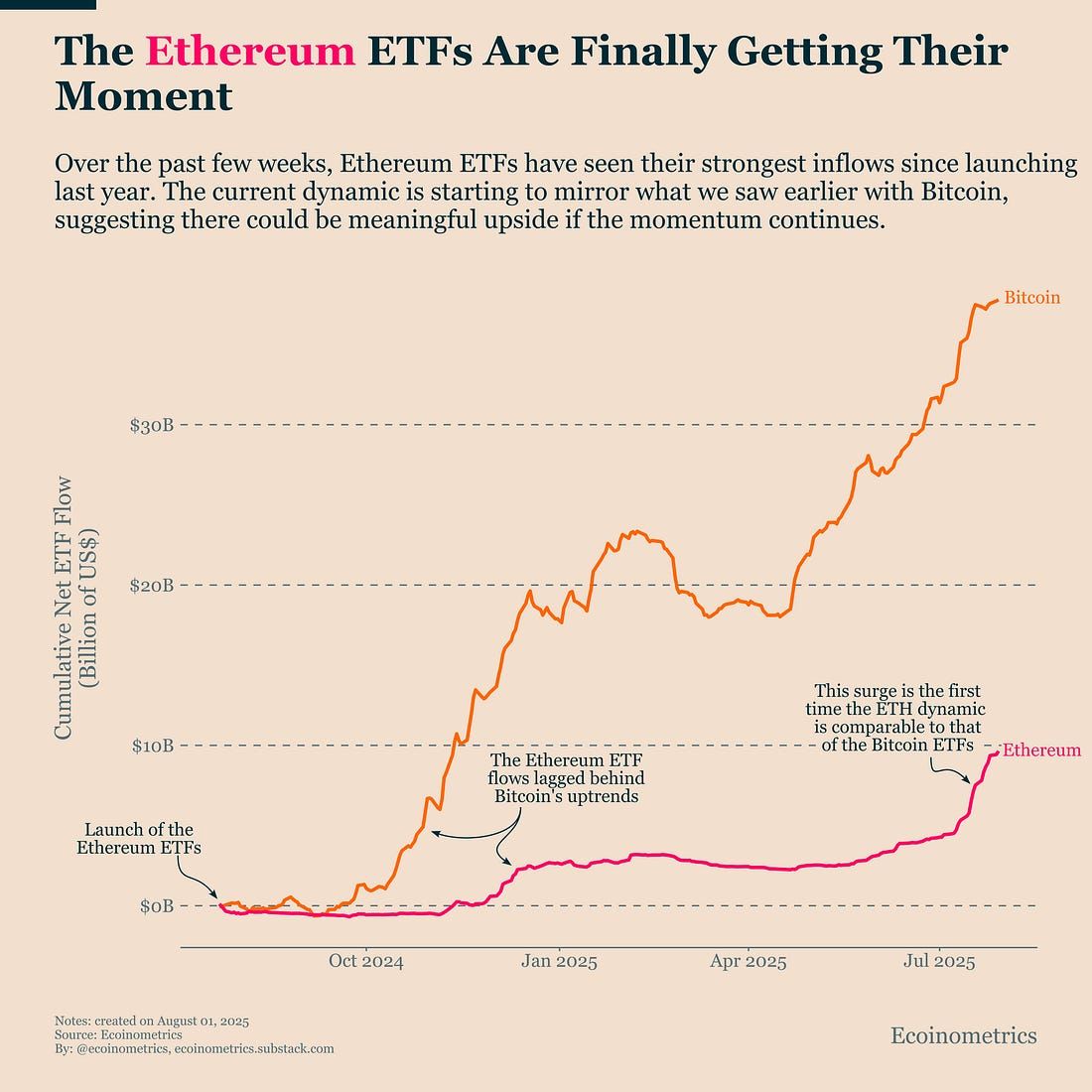

Ethereum ETFs are finally seeing inflows on a scale we previously only witnessed with Bitcoin (see graph below).

For most of the past year: ETH ETF flows were minimal, often lagging behind Bitcoin.

Last month changed that: Net inflows into ETH ETFs surged to levels comparable to BTC ETFs at the start of their run.

What this means: Sustained inflows could create the same upward price pressure for ETH that drove BTC to new highs.

This is the first sign of capital moving further out the risk curve, a key marker of the second half of a crypto bull market, where Ethereum and other large-cap altcoins often begin to outperform.

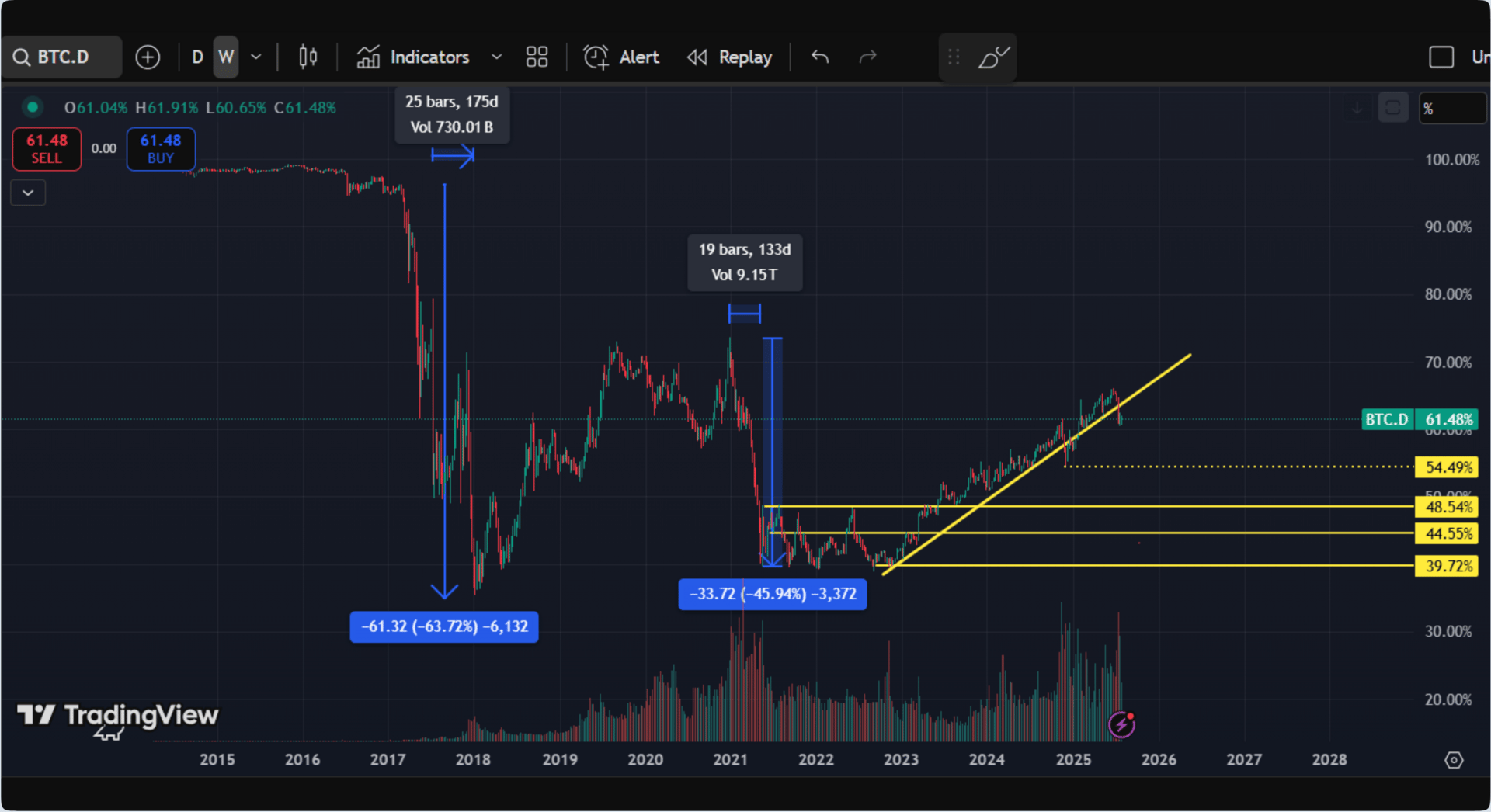

Bitcoin Dominance (BTC.D): The Rotation Compass

To understand when altcoins gain strength, we must track Bitcoin Dominance (BTC.D): the percentage of total crypto market cap held in BTC.

The Anatomy of Dominance:

When BTC.D rises:

Capital seeks safety in Bitcoin, the market’s deepest liquidity pool.

This often occurs in corrections or early bull phases.

When BTC.D falls:

Capital rotates into altcoins for higher returns.

Historically, dominance drops signal the start of altcoin rallies.

BTC.D isn’t just a number; it’s a map of market sentiment and capital rotation.

Dominance Support Bands: Your Action Plan

BTC Dominance has five historical support bands. Each is a rotation waypoint where the market decides whether to stay in BTC or move into alts:

61.0% – Trendline Support (Today’s Level)

Psychology: Market is cautious, ETH leads rotation.

Action: Maintain ETH core (50% of risk capital). Begin 10-20% allocation to top-tier alts (SOL, SUI, TAO).

54.5% – Historical Pivot

Psychology: First real confirmation of altseason.

Action: Shift 20% of ETH gains into mid-cap alts (WELL, RENDER).

48.5% – Mid-Cycle Support

Psychology: Institutions rotate out of BTC into higher beta plays.

Action: Deploy 50% of ETH profits into small-cap thematic plays (AI, modular chains).

44.6% – Panic Zone

Psychology: Retail capitulation, fear peaks, best asymmetric entries appear.

Action: Move 80% of total trading capital into a diversified basket of high-conviction alts.

39.7% – Macro Floor

Psychology: Generational accumulation zone, take profits aggressively after altseason peak.

By mapping dominance levels to clear actions, you avoid emotional decision-making and rotate into alts with precision instead of chasing green candles.

Execution Psychology: The Hold-and-Scale Mindset

The biggest mistake in rotations is emotional execution:

Traders enter too early out of fear of missing out.

Or they hesitate, waiting for “perfect” confirmation, and miss the first 30% of the move.

Our framework:

Wait for confirmation at key dominance levels (support bounces or breaks).

Scale in systematically:

25% on first signal

25% on retest

50% after volume confirmation

Detach emotions from market noise by focusing on structure, not feelings.

When you act with structure and conviction, you survive volatility and capture the asymmetric upside that most market participants miss.

Conclusion

Ethereum ETFs are finally stepping into the spotlight, echoing the early inflow patterns that propelled Bitcoin higher.

At the same time, BTC Dominance is hovering at 61%, the very first support band of our Rotation Map.

If Dominance holds: Expect a slower ETH-led rotation.

If Dominance breaks down: Prepare for a true altseason, with ETH and select alts outpacing BTC.

This is the phase where structured, data-driven rotation can turn patience into outsized returns.

Your Next Step

Stay ahead of the market by tracking:

ETH ETF inflows – the early fuel for ETH’s breakout.

BTC.D support bands – your rotation roadmap.

Alt allocations – scale with structure, not emotion.

If you want real-time insights and actionable rotation levels every week, make sure you subscribe to our Lighthouse Newsletter.

Learn How to Rotate

If you want help navigating this altseason with real structure and conviction — not hype — join our premium weekly newsletter:

✅ High-conviction setups

✅ Rotational playbook

✅ Timing signals based on momentum and structure

✅ Built for people with real jobs and real lives

Or go all-in with full access to both Crypto & Equity Lighthouse for the price of one rally missed.

Start positioning while the rest scroll.

This is your edge. Don’t waste it.

—

Saâd

from Swiss Islamic Finance