- Swiss Islamic Finance

- Posts

- Market Correction, Diverging Assets & Macro Shifts

Market Correction, Diverging Assets & Macro Shifts

What You Need to Know Now

Understanding the Ecosystem

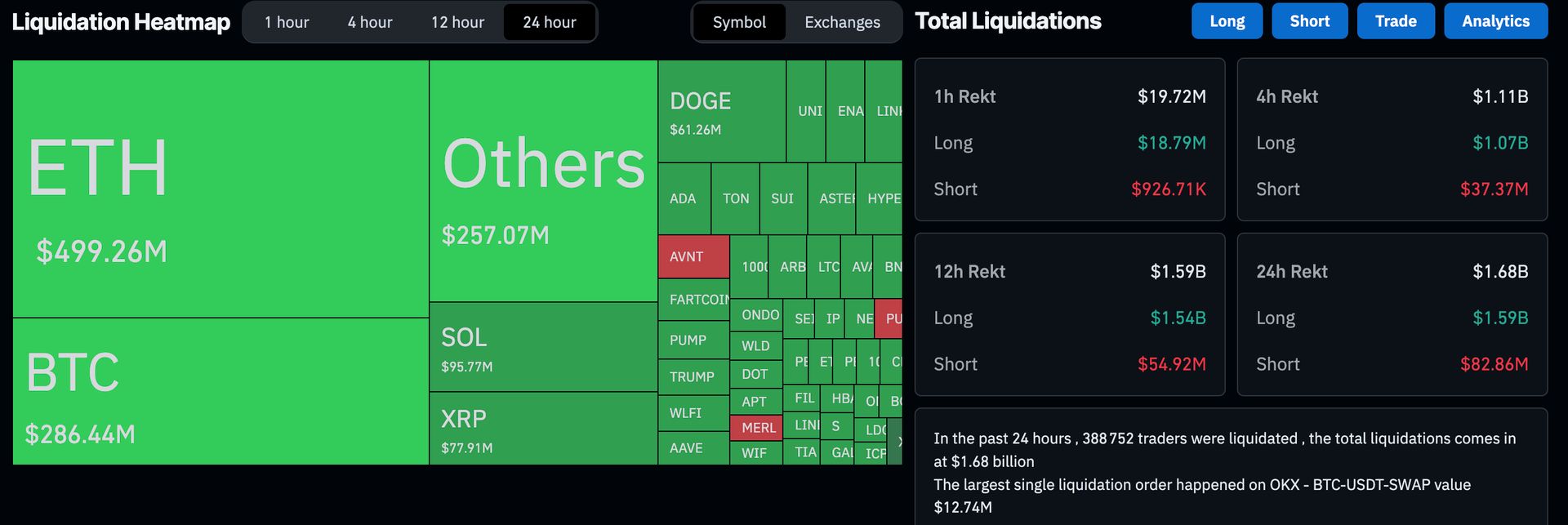

In the last 48 hours, the crypto markets have witnessed one of the largest liquidation waves of the year:

Over $1.7 billion in leveraged positions were wiped out, affecting more than 400,000 traders. The largest single liquidation was a $12.7 million BTC-USDT swap on OKX.

This wasn’t just a dip, it was a structural reset.

When traders borrow too much and the market turns against them, exchanges automatically close their positions. This creates a domino effect: one liquidation triggers another, accelerating the drop.

👉 And what’s visible on-chain only tells part of the story: much of the leverage and liquidation activity happens off-platform or untracked.

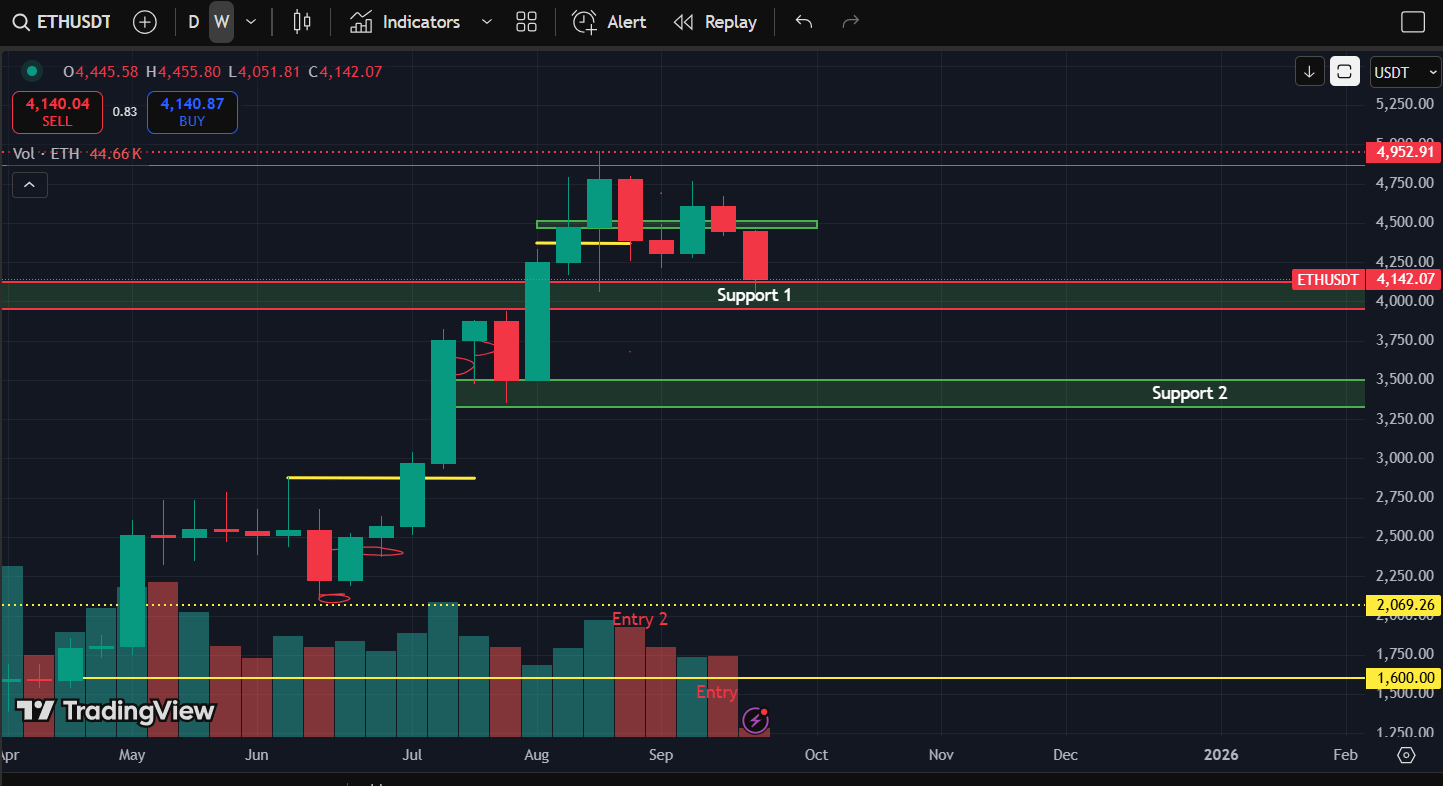

Bitcoin & Ethereum: Pressured but Intact

Bitcoin dropped around 2.5%, dipping to $112,000.

Ethereum lost over 6%, falling to $4,200 — showing how leveraged altcoins are more exposed to sharp corrections.

ETH

Despite this:

BTC is still up 17% YTD (Year-to-Date)

ETH remains a central pillar of the crypto ecosystem

This correction is a reminder, not a reversal. Speculative leverage got punished. But structurally, the bull cycle remains intact.

Gold & Silver Rally While Crypto Dips

As crypto traders faced cascading losses, gold quietly hit a new all-time high at $3,721, up 43% this year.

Silver rose 1.5% to nearly $44, posting a 50% YTD gain.

📊 The timing is telling: some capital clearly rotated from crypto into classic safe havens. This doesn’t mean crypto is losing ground, it means markets are rebalancing after a speculative build-up.

Diverging Market Flows

BNB broke above the psychological $1,000 mark, hitting an ATH of $1,080 before pulling back slightly. Momentum, token burns, and core utility are fueling the narrative. If $1,000 holds as support, the rally might extend.

BNB

ASTER, a newly launched token backed by Binance and CZ, surged several hundred percent post-launch.

It’s the classic playbook: speculative frenzy → volatility → consolidation.

If Binance continues building on it, ASTER may have long-term upside, but for now, it’s high risk/high reward.

We're in a selective market phase — no longer a broad “everything rallies” environment. Winners and losers are separating fast.

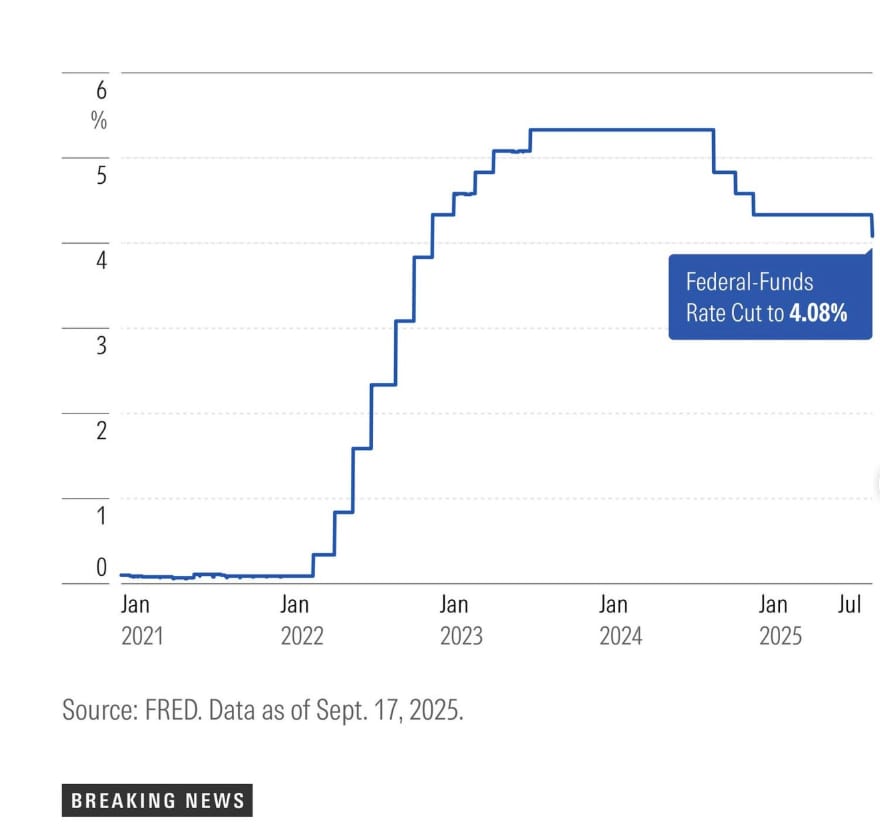

Macro Outlook: The Fed Has Pivoted

The Federal Reserve just cut rates by 0.25%, bringing the range down to 4.00–4.25%, marking the start of a new easing cycle.

Why now?

Not because inflation is solved, it’s still above target

But because growth and job creation are slowing, and the Fed wants to avoid triggering a recession

✅ Rate cuts = cheaper borrowing = more liquidity.

That’s bullish for stocks, bonds… and especially for crypto.

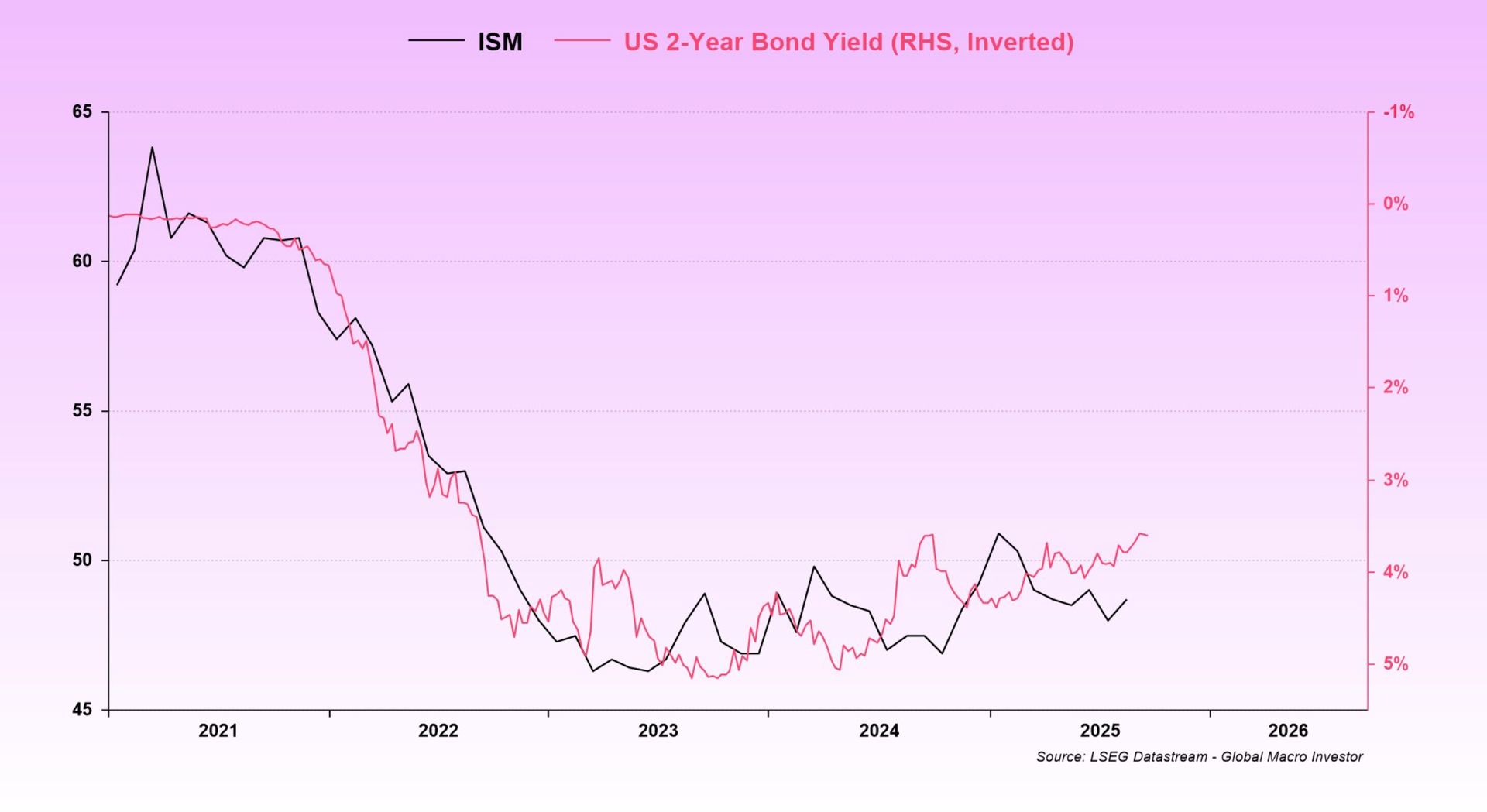

Wall Street vs Main Street: The Disconnect

A key chart compares:

ISM (a pulse of the real economy) → still weak

2-year US bond yields → falling, signaling future recovery

What it means:

Liquidity has returned

But earnings haven’t yet caught up

Valuations are stretched… and betting on 2025–2026 to deliver the real growth

Lower rates now are the bridge between liquidity and future economic expansion.

Our Investor Takeaways

Liquidations show fragility in over-leveraged positions — but this is a reset, not a collapse

Macro fundamentals (lower rates, positive flows) still support crypto long-term

We are now in a mature phase of the cycle, no longer a free-for-all, but a test of discipline and rotation

👉 This is the phase where real investors win:

Those with structure, with targets, with patience.

Stay Ahead with Swiss Islamic Finance

Want to follow this cycle with clarity and conviction?

We break down every market move — from macro to micro — and help you align your strategy with your principles.

Or go all-in with full access to both Crypto & Equity Premium Subscription for the price of one rally missed:

Every week, we break down what matters in the market, and how Muslims can navigate the new digital economy with clarity and conviction.

—

Saâd

from Swiss Islamic Finance