- Swiss Islamic Finance

- Posts

- Saâd's Crypto Market Outlook

Saâd's Crypto Market Outlook

Markets test key levels as macro, liquidity, and fear collide

Zooming Out

This week is all about macro. Between the PPI, retail sales, GDP, and PCE data, any unexpected print could shatter the current low-volatility environment.

But tread carefully—Thanksgiving week means reduced volume and thinner liquidity, which can lead to sharper, less predictable market moves.

Your Move:

Stay tactical, not aggressive.

Use light DCA entries if data is favorable.

Stick to quick tactical trades if volatility spikes.

Stay patient and keep dry powder in case macro shocks return

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

Macro Minute: Good Earnings, Bad Reaction

Nvidia beat earnings, but the market didn't celebrate. Nasdaq dropped –2.7%, volatility surged (VIX jumped from 20 to 28), and investors rotated into defensive sectors like consumer staples.

Job market: Soft landing… with a catch. U.S. added 119k jobs, beating expectations, but unemployment ticked up to 4.4%. That complicates the Fed’s rate cut calculus.

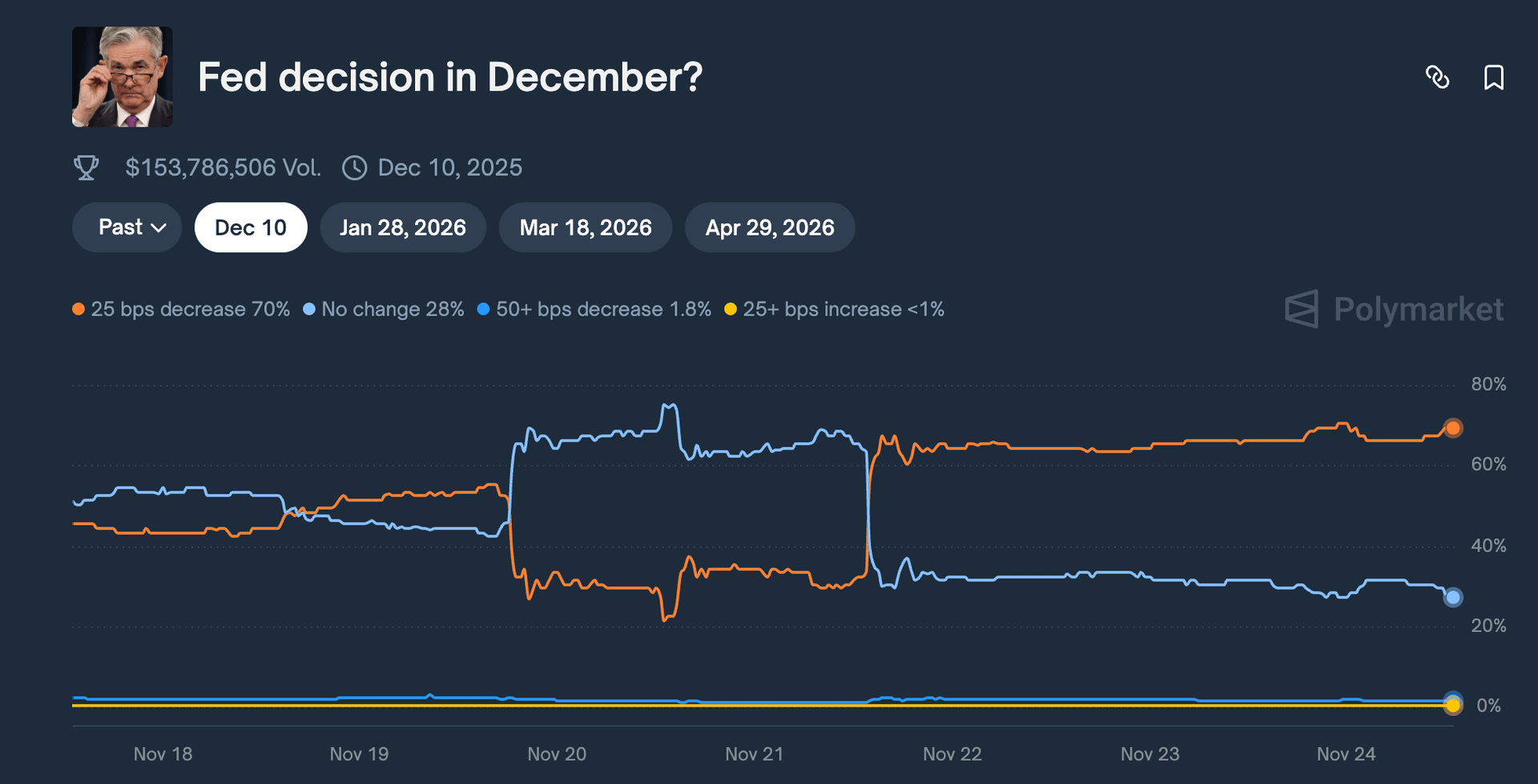

Rate cut odds? Still a coin flip. Markets wavered between optimism and doubt all week. After NY Fed’s Williams hinted at dovishness on Friday, December rate cut odds bounced back to ~70%.

Europe: Expansion Without Momentum

Eurozone PMI shows continued expansion in services, but manufacturing dipped back under 50. Job cuts ticked higher. Overall: stable but uninspiring.

Geopolitics: War Headlines Still Matter

U.S.–Ukraine talks in Geneva hinted at progress. European proposals are evolving. Too early for conclusions, but energy and European cyclicals may respond short-term.

Crypto Ecosystem Pulse

It was another painful week.

Crypto ETPs saw outflows of $2B—the third worst week of the year.

BTC funds: –$1.3B

ETH funds: –$680M

This marks the third consecutive week of net outflows, with investors staying on the sidelines awaiting macro clarity.

The CMC Fear & Greed Index is now at 11: deep in "Extreme Fear."

Market sentiment is scraping the bottom, with liquidity thin, ETF redemptions accelerating, and macro fog thick.

The market’s been risk-off across all sectors:

RWA: –8.6%

Infrastructure: –19%

BTC: –10%

AI: One of the worst performers — speculative narratives suffer most when liquidity dries up.

Only a few tokens closed in the green:

TNSR: +250% (tokenomics revamp & lockup extensions)

Ready (Gaming) and GRASS (AI) also made the podium.

Bitcoin (BTC)

BTC

BTC broke the $92,900 support and retested the major $83,230 level.

So far, it held. We’re now hovering around $86K, forming a base.

📊 Key zones to watch:

Reclaiming $92,900 = early signal for rebound

If that confirms, path opens back to $100K+

Failure = downside risk to $76,400–$74,650, an important accumulation zone last tested in April.

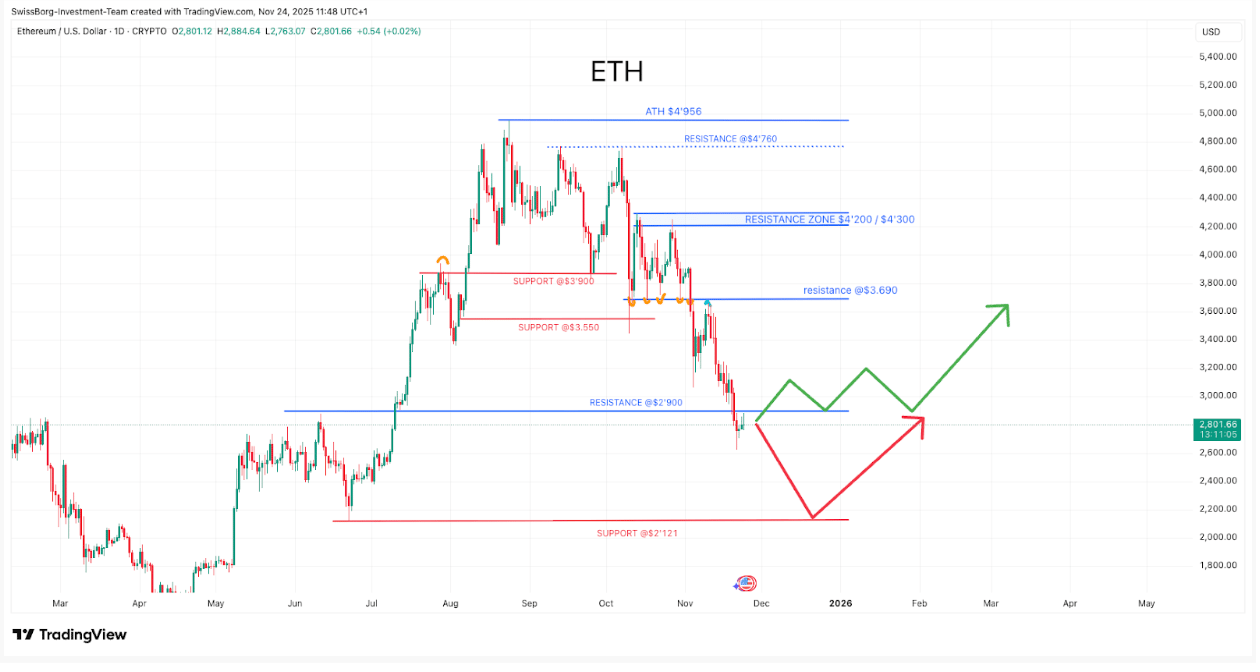

Ethereum (ETH)

NASDAQ (Bloomberg)

ETH dropped below $2,900, turning that level into resistance.

Next key support = $2,121, potential rebound zone.

Reclaiming $2,900 flips structure bullish and signals potential reentry into its summer consolidation range.

Solana (SOL)

Still in its descending channel. Currently testing the $127 support.

Breakdown = fast slide to $95

Hold + defend = bounce potential back toward $157

Still too early to call: watch how this lower trendline reacts.

Liquidity Watch: A Turning Point?

The Fed just confirmed it will end QT (quantitative tightening) starting December 1st. That means:

They’ll reinvest maturing Treasuries & MBS

No more draining $95B/month from the system

This isn’t full QE yet… but it’s close.

Liquidity expansion is coming, and historically, that’s been rocket fuel for:

Tech

Crypto

AI & semis

Growth equities

The Fed is lifting the weight off markets’ shoulders after three years of tightening.

Add a potential rate cut in December, and we could be entering a fresh risk-on phase —> if macro data doesn’t derail the shift.

Final Word

We’re in a window where volatility, fear, and low liquidity combine into a strange brew.

But beneath the surface, supports are holding and the Fed is blinking.

If macro data plays nice this week, it could trigger the first leg of a relief rally, especially in BTC, ETH, and growth stocks.

But remember: this is still tactical territory, not full risk deployment.

Plan your trades. Protect your capital. Position with intent.

Want our exact portfolio positioning, weekly trade setups, and live market breakdowns?

👉 Join our private Skool community for weekly reports, altcoin rotations, and exit frameworks:

Stay strategic. Stay grounded. Stay halal.

Believe or not, next phase is here.

—

Saâd

from Swiss Islamic Finance

Invite Your Friends

If you enjoyed this issue, forward it to someone who’s asking if “Bitcoin topped”, they’ll thank you later: