- Swiss Islamic Finance

- Posts

- Saâd's Weekly Market Outlook

Saâd's Weekly Market Outlook

Configuration remains familiar, but the calendar just turned hostile.

The Playbook This Week

Salam,

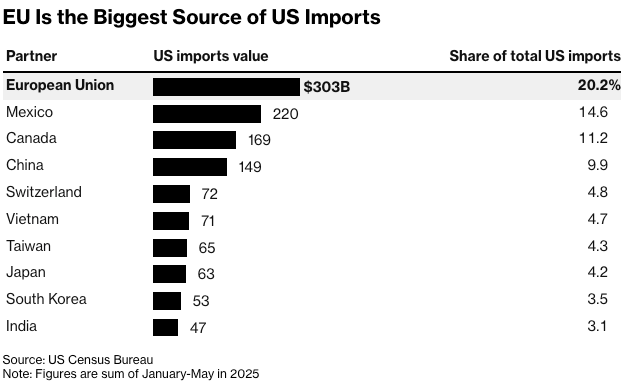

Over the weekend, the U.S. administration reopened a geopolitical front, threatening 10% tariffs on eight European nations, explicitly linked to the Greenland standoff. The move is reigniting the 2018 trade war playbook. Markets are responding as expected: risk-off open, gold up, and crypto still range-bound.

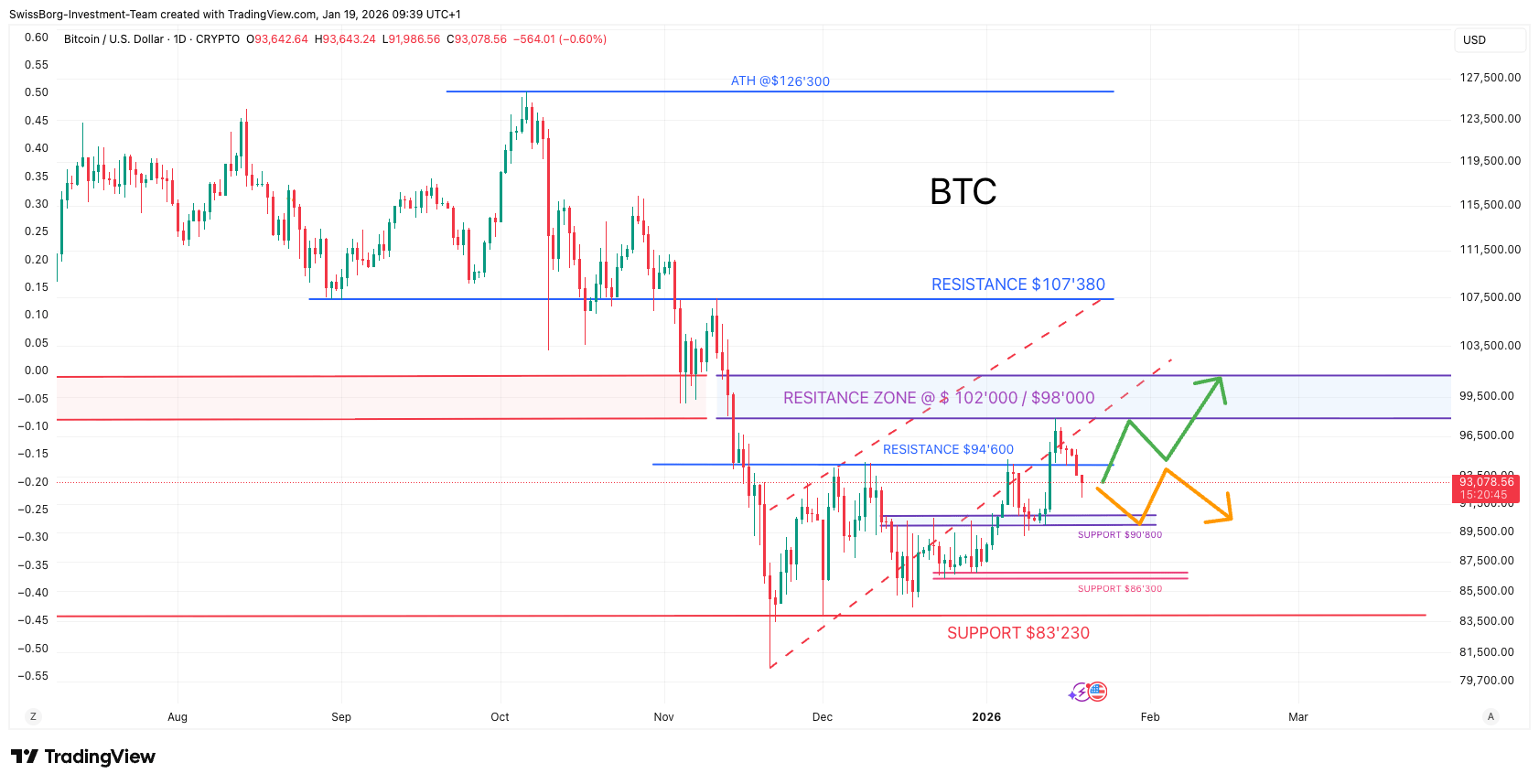

BTC remains capped under the $94,600 decision zone, while macro data and crypto flows suggest positioning is rebuilding, but cautiously.

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300.

Program begins February 9.

What To Do

Keep it simple, like last week.

Focus on BTC, ETH, and SOL.

Only add if confirmed breakouts.

Trim if breakdowns persist.

Avoid overtrading alts unless you have a clear edge.

Macro Minute

Greenland → Trade War 2.0?

Trump’s new tariff threats (Feb 1st deadline) tied to European stances on Greenland have triggered early EU retaliation prep, including a €93B counter-package.

Markets opened Monday with a clear read: geopolitical risk = equities and BTC down, gold up.

By the way…

You’re still missing out on this (and it’s free):

🚨 Only 39 34 free spots remaining. After that, access moves to paid subscription.

U.S. Inflation Holds Steady

CPI for December came in at +0.3% m/m and +2.7% y/y, in line with soft landing expectations, but not soft enough to force aggressive Fed cuts:

U.S. Labor Still Strong

Initial jobless claims fell to 198k: lowest in two years. A resilient labor market means less urgency for Fed rate cuts, but continued support for growth.

This Week: Key Macro Events

Wed, Jan 21 (Global): Trump’s Davos speech: potential EUR, EU equities, and safe haven volatility.

Thu, Jan 22 (EU): Emergency summit on tariffs & retaliation.

Thu, Jan 22 (US): Delayed PCE inflation data: Fed’s preferred gauge.

Fri, Jan 23 (Global): Flash PMIs: early read on global growth momentum.

Understanding Market Structure

ETF Flows Turn Risk-On

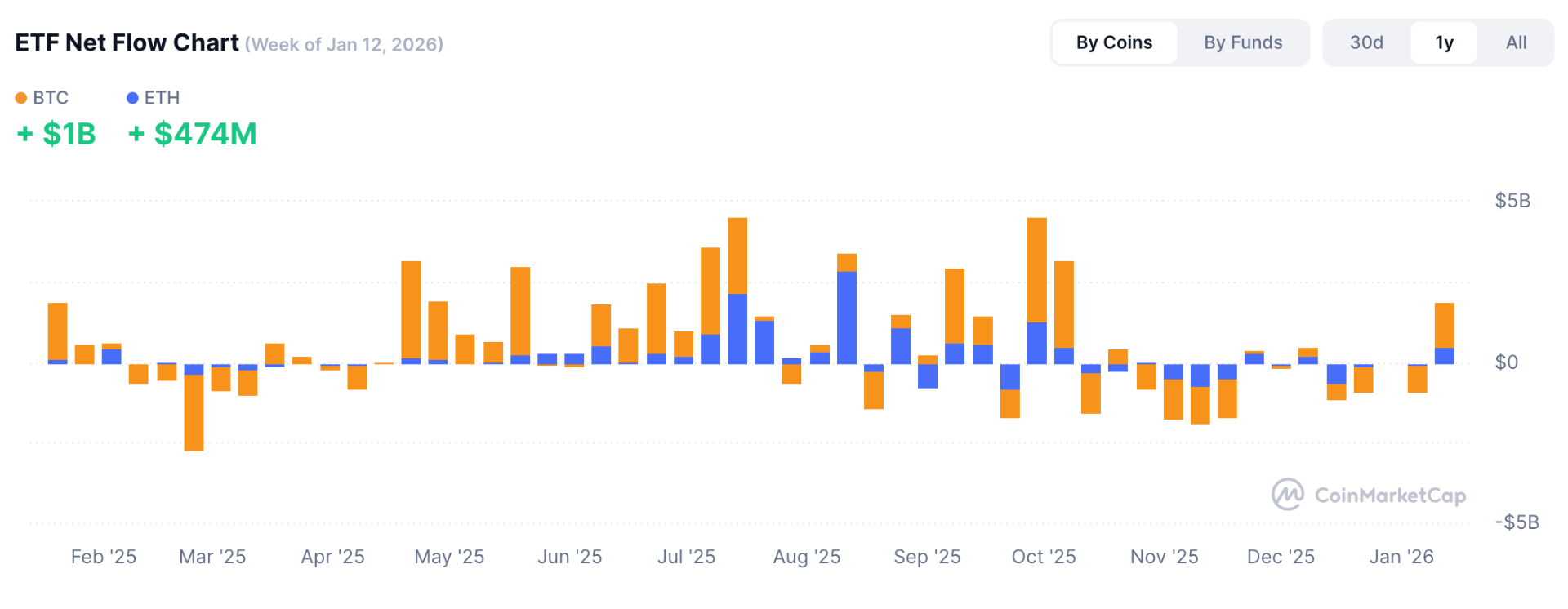

Bitcoin and Ethereum ETFs saw their largest inflows since October 2025, over $1B into BTC and $479M into ETH. Institutional demand is rebuilding as price volatility fades.

🟢 Fear & Greed Index: 45/100

🟡 Altcoin Season Index: 27/100

⚖️ Crypto Market Share: BTC 59.1% / ETH 12.3% / Others 28.5%

Ethereum Validator Dynamics

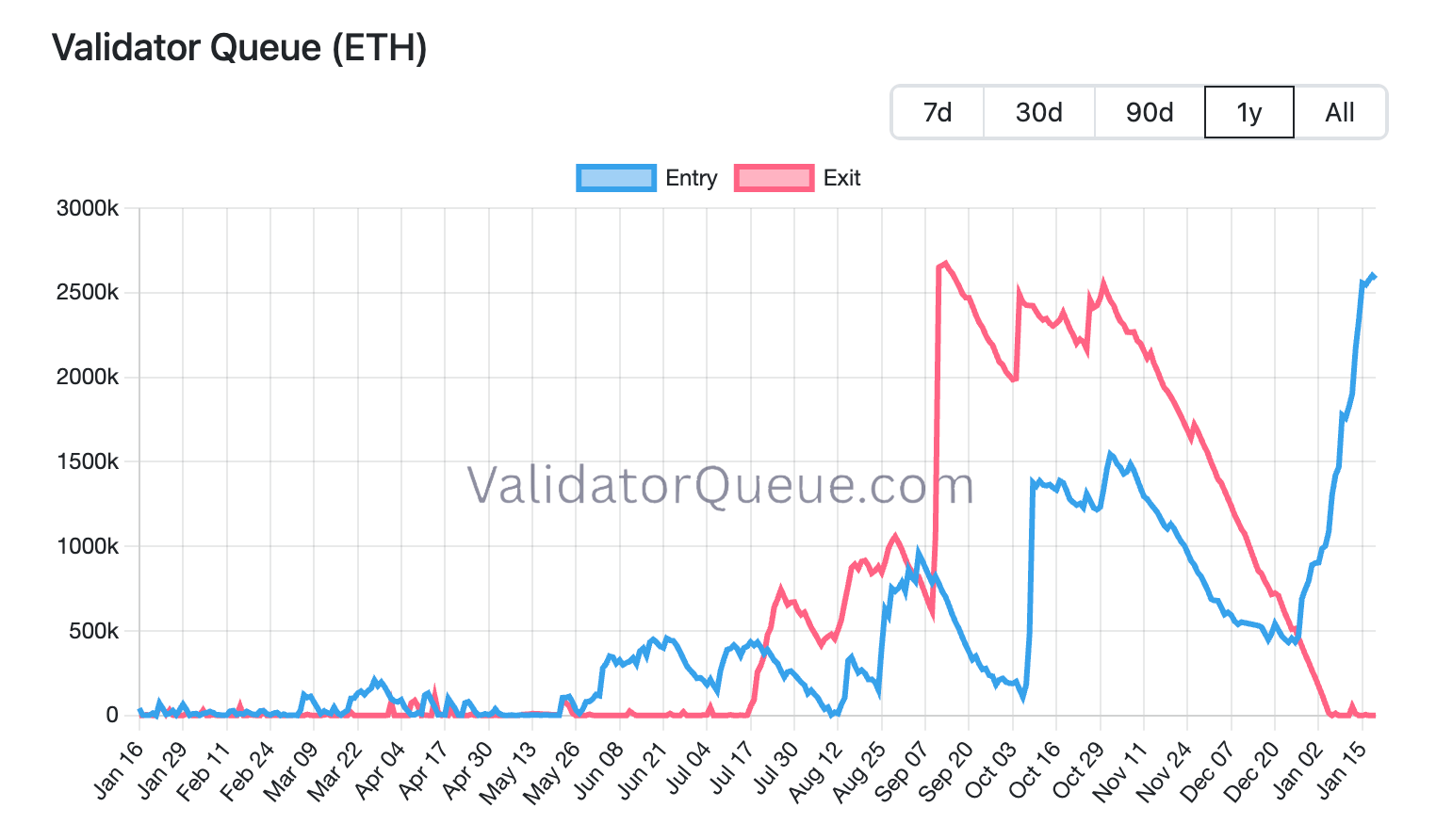

ETH staking queue surged to 2.62M ETH, while the exit queue is nearly empty. It now takes ~45 days to enter the validator set. More ETH is locking in, reducing circulating supply.

Token Watch

Bitcoin (BTC)

📍 Price: $92,932

Support: $83,230 / $76,400

Resistance: $94,600 / $98,000 / $102,000

BTC failed to reclaim $94,600 after a false breakout last week.

We remain in a broad consolidation. Two paths emerge:

Slow grind back to $98–102k (bullish if confirmed)

Sideways chop, possibly down to retest lower supports

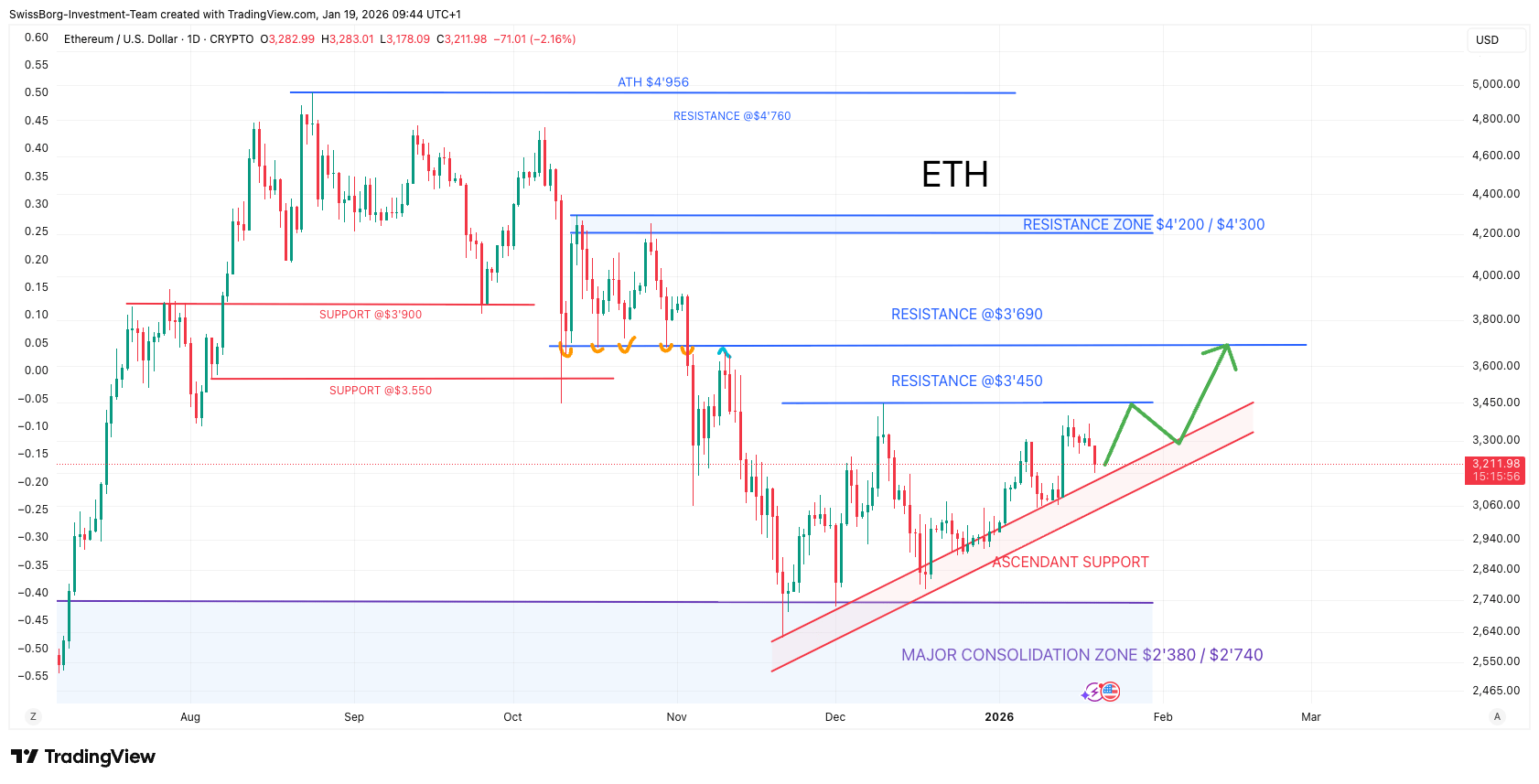

Ethereum (ETH)

📍 Price: $3,214

Support: $2,740 / $2,380

Resistance: $3,450 / $3,690 / $4,300

ETH continues to build within a bullish ascending triangle.

A breakout above $3,450 would unlock $3,690+, with ATH retest as a longer-term target. On-chain staking dynamics remain constructive.

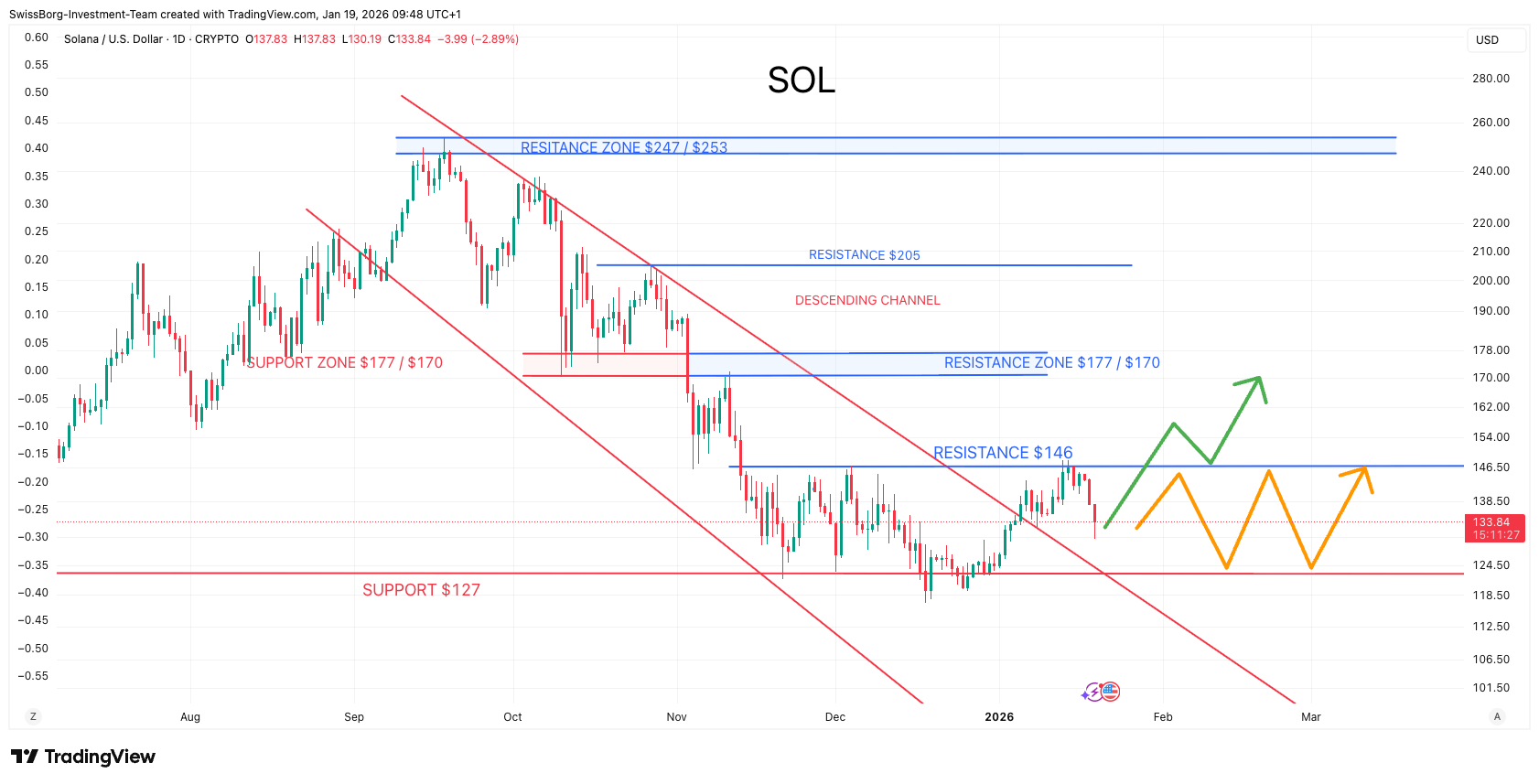

Solana (SOL)

📍 Price: $133.4

Support: $127 / $95

Resistance: $146 / $157 / $177

SOL broke out of its descending channel, signaling a possible regime shift.

But it's now trapped between $127 and $146. A clear breakout above $146 could open the door to retest $170–177.

Final Take

Markets are in a fragile but constructive phase.

Liquidity is returning, not from the Fed, but from fiscal, geopolitical, and structural plays. The key is timing and positioning.

If you’re not prepared for the coming rotation, you’ll be late to the biggest upside in years.

Skool Community: Join Early, Join Free

🔐 Our private investing community is now open to early members.

Get access to:

📆 Daily/weekly market updates

📈 Halal equity & crypto portfolio strategies

🌍 Global Islamic finance network

🎓 Beginner to advanced investment resources

💬 Smart, ethical investor conversations

🚨 Only 39 34 free spots remaining. After that, access moves to paid subscription.

—

Saâd

from Swiss Islamic Finance