- Swiss Islamic Finance

- Posts

- The Final Acceleration: ETH Leads, Altseason Follows

The Final Acceleration: ETH Leads, Altseason Follows

ETH is breaking out, capital is rotating, and altseason is accelerating — here’s exactly what to watch and how to position now.

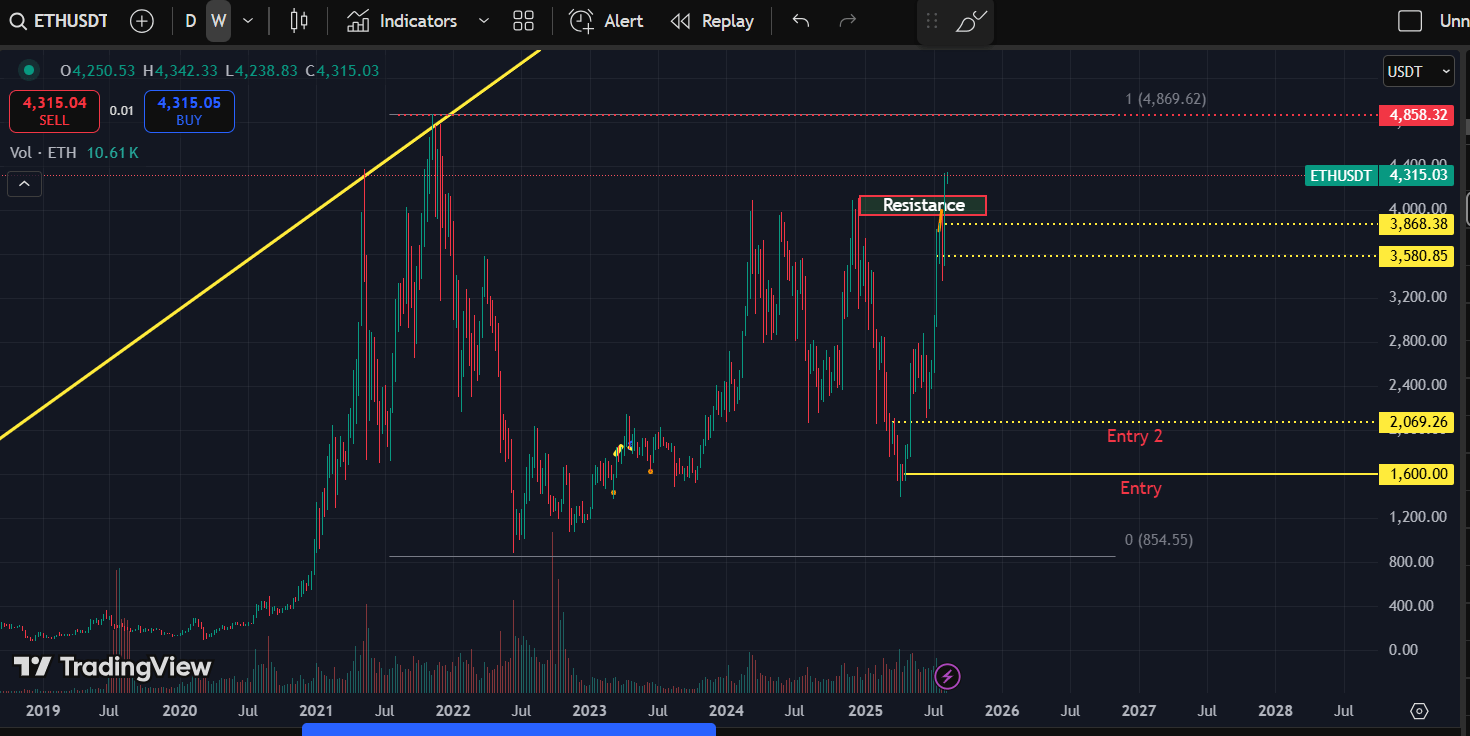

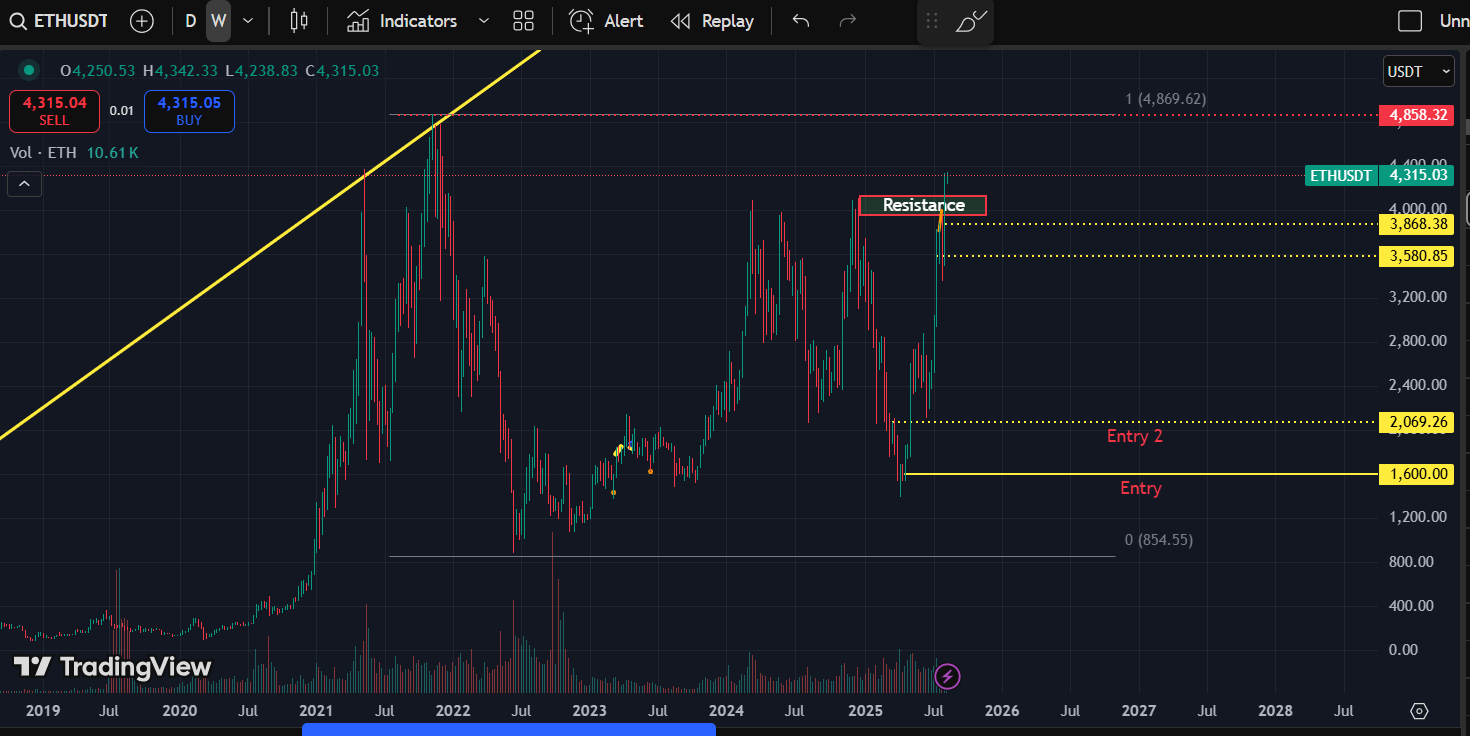

Zooming out

Ethereum is firmly above $4,000.

The altcoin rotation has begun.

And we’re now entering the final acceleration phase of this cycle.

Let’s break down what this moment means, what to watch next — and what to actually do.

Sponsor

Never miss a dip again.

Uniswap is a trusted way to swap and explore crypto across chains.

Browse, research, and swap tokens without leaving Uniswap. Stay in control of your crypto.

ETH Has Broken Through

This isn’t noise.

Weekly structure is strong.

The $3,580 level — our last major support — held beautifully. That’s your anchor. As long as we stay above it, pullbacks are not panic signals. They’re buy zones.

The next major level?

$4,800 — the prior all-time high.

And above that? $7,300, based on the Fibonacci extension from this breakout leg.

Between $4,000 and $4,800, there’s no serious structural resistance.

So if we move, we move fast.

But if you’re waiting for a textbook 4,000 retest… remember: market makers hunt your Stop Loss, not comfort. The pullback may never come.

ETH ETF Inflows Are Fueling This

Just like BTC earlier this year, Ethereum’s spot ETF flows are finally here — and they’re real.

We’re now seeing Bitcoin-scale demand for ETH.

That changes everything.

ETF flows aren't hype — they’re capital. And when capital flows shift, price follows. This is the same pattern that sent BTC to new all-time highs. ETH is next.

The fundamentals are aligning with price action.

That’s not coincidence — it’s structure.

The Rotation Is On

While headlines still scream about Bitcoin, smart capital is rotating.

Watch the metrics:

BTC Dominance is stalling.

ETH Dominance is rising.

ETH/BTC is strengthening — a telltale sign of risk-on rotation.

TOTAL3 (altcoin market cap excluding BTC & ETH) is pushing on a key breakout zone.

This is the same pattern we saw in Q1 2021 and mid-2020:

BTC → ETH → Majors → Narratives → Full Altseason

And that’s where we are now.

You’re Closer Than You Think (But Most Fumble Here)

Here’s what happens next — and how most retail traders mess it up:

They finally believe the move.

They ape in at highs.

Then a red candle hits.

And they panic out… right before the real run begins.

Let me be clear:

You didn’t survive 2022 just to fumble 2025.

You didn’t read these newsletters, track these cycles, hold conviction for months — just to exit now out of fear.

This part of the cycle rewards structure, not emotion.

What You Should Be Doing Right Now

Whether you’re in position or still waiting, here’s your playbook:

If you’re in ETH or majors:

Don’t micromanage your trades.

Let structure guide you, not fear.

As long as ETH holds $3,580, stay in the game.

If you’re on the sidelines:

Deploy 20–30% now to have exposure.

Save the rest for a possible dip to 4,000–4,100.

If price pumps without you, focus on alt laggards still below their April highs.

Charts you must watch on TradingView:

BTC.D– Are we rotating out of BTC?ETH/BTC– Is ETH still gaining strength?TOTAL3/BTC– Are alts outperforming Bitcoin?ETH.D– ETH’s market dominance trendSOL/ETH– Rotation between ecosystems(TOTAL3 - USDT - USDC)/ETH– Real altcoin flows, not just price noise

The Game Is Psychological Now

You’ll be tempted to rotate early.

To trim too fast.

To panic on the first red candle.

Or worse — to freeze and do nothing.

Don’t.

Set levels. Have structure. Rotate with intent.

This cycle is moving faster than the last. And there’s less room for indecision.

Final Thought

This is the moment where wealth is made — or missed.

Don’t overcomplicate it.

Don’t rely on hopium.

Don’t copy influencers.

Track the flows. Follow the structure. Hold your nerve.

And if you want the exact setups, weekly market maps, and positioning strategy?

👇

Or go all-in with full access to both Crypto & Equity Lighthouse for the price of one rally missed.

And share this with someone you know needs to read it before they make a mistake they’ll regret for 4 more years.

—

Saâd

from Swiss Islamic Finance