- Swiss Islamic Finance

- Posts

- Your weekly Market Outlook

Your weekly Market Outlook

Once again, the market didn't rest during Sunday.

Zooming out

Look.

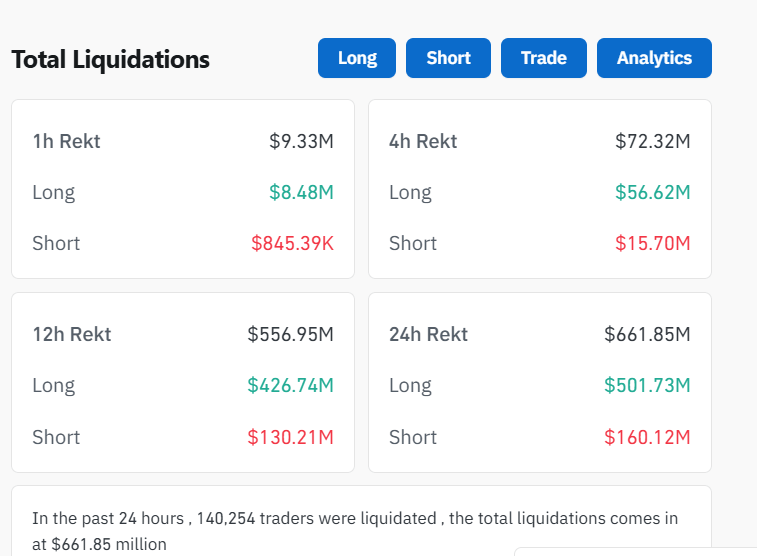

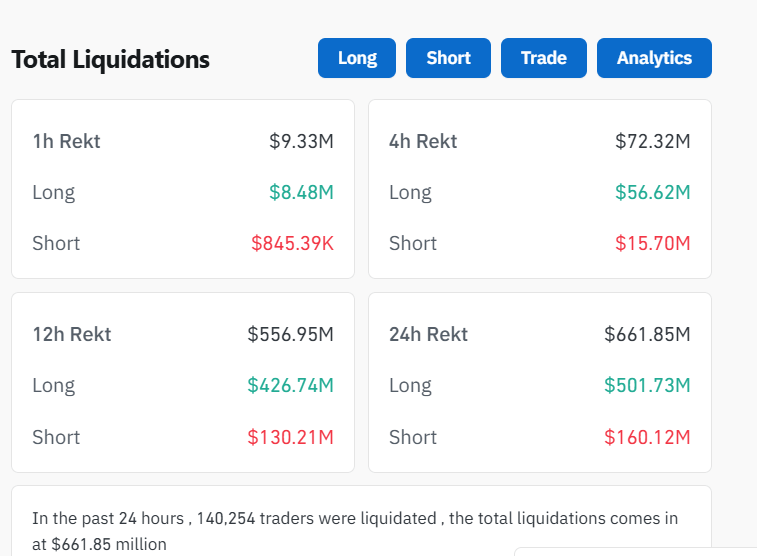

The market liquidated half a billion on Sunday.

Makes it even clearer that if you don’t have a plan, you will lose your money again and again.

Now back to the market.

Swap, Bridge, and Track Tokens Across 14+ Chains

Meet the Uniswap web app — your hub for swapping, bridging, and buying crypto across Ethereum and 14 additional networks.

Access thousands of tokens and move assets between chains, all from a single, easy-to-use interface.

Trusted by millions, Uniswap includes real-time token warnings to help you avoid risky tokens, along with transparent pricing and open-source, audited contracts.

Whether you're exploring new tokens, bridging across networks, or making your first swap, Uniswap keeps onchain trading simple and secure.

Just connect your wallet to get started.

1. Bitcoin (BTC) ~$110’390

Support: $111,900–$112,000

Resistance: $115,200–$115,800

BTC is trading down roughly 2% intraday, holding near critical support. The recent high at $115.2K stands as a resistance point. If BTC breaks below $111.9K, it opens the door to deeper retracement, possibly to $110K. Conversely, a weekly close above $115K signals late-cycle continuation, though signposts suggest BTC fatigue in its dominant role.

My take

BTC leads the cycle. Right now it's in tuck-and-watch mode. A hold here keeps structure valid. A breakdown, and rotation to ETH + pockets of strength elsewhere accelerates.

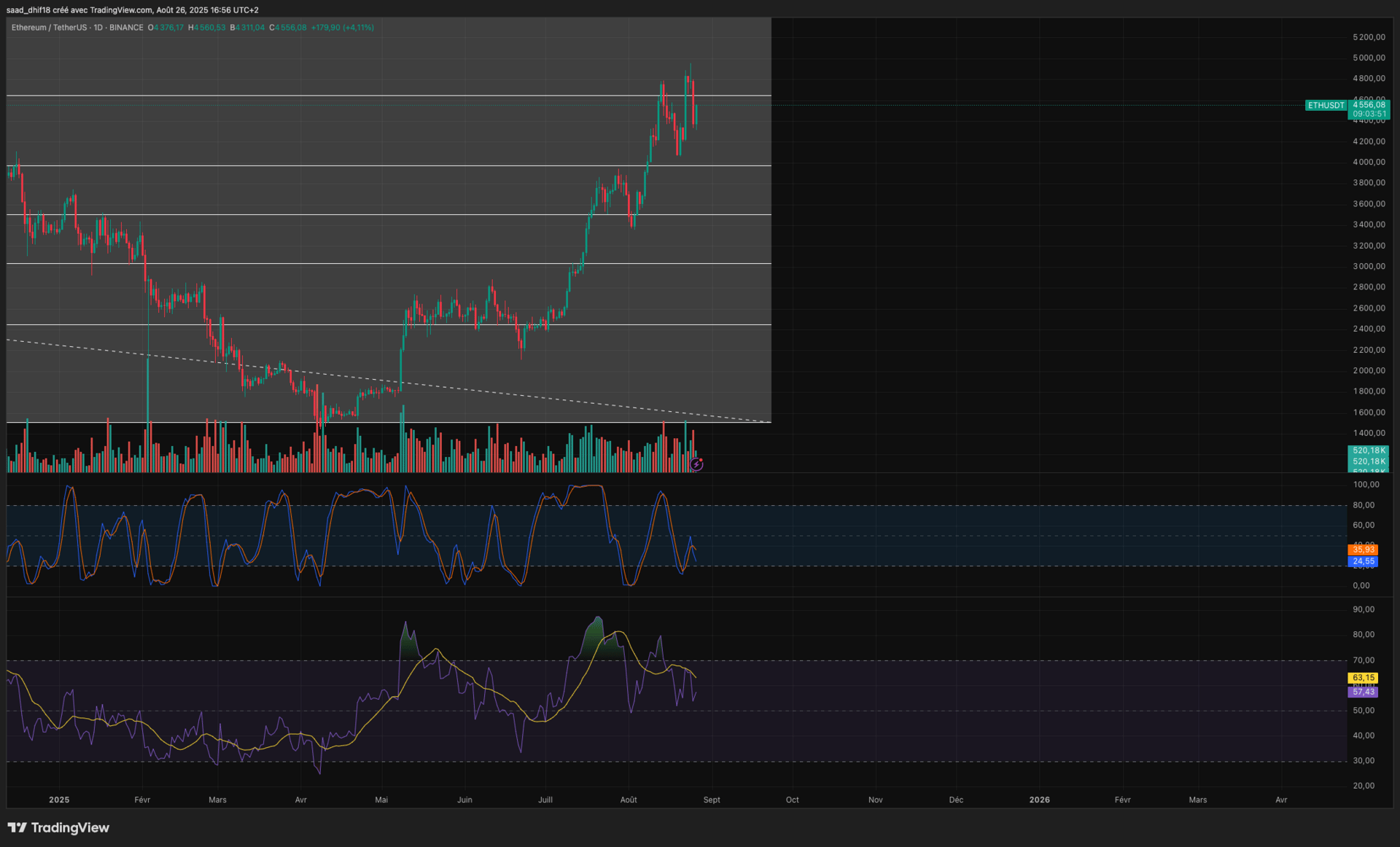

2. Ethereum (ETH) ~$4’561

Support: $4,680–$4,700

Resistance: $4,950–$5,000

ETH recently hit a fresh ATH above $4.9K before pulling back to test consolidation. That puts resistance overhead, but nothing structurally major between current levels and $5K. The lack of violent retreat suggests bulls are accumulating on minor weakness rather than panic dumping.

My take

ETH is showing real strength while BTC wavers. Institutional flows, ETF action, and sheer demand are layering bids. A clean break with volume over $4.95K could fast-track continuation.